Today’s Greatest Sustainability Challenges Present Both Risks and Opportunities

Author: Mojca Markizeti, Member of the Working Group of Chapter Zero Slovenia; Expert in Sustainability Strategies, Business Development and Innovation and Founder of Improve X Advisory

The World Economic Forum has developed a set of eight principles to guide the development of effective climate governance. To make these principles useful and tangible, each of them is accompanied by a set of guiding questions. These questions help organisations to identify and address potential gaps in their existing climate governance strategies.

As Chapter Zero Slovenia is committed to ensuring that its board members pursue climate governance, we have produced a series of monthly articles explaining the eight climate governance principles, which are designed to increase their climate awareness, embed climate considerations into board structures and processes and improve navigation of the risks and opportunities that climate change poses to business.

Board members should continuously assess short-, medium- and long-term climate risks and opportunities and take appropriate action based on their relevance to the company.

The assessment of climate risks and opportunities is often (or will be) required by a company's stakeholders: investors, the financial market, business partners and, in the last year, by rules and legislation in an increasing number of markets.

This is not because of some desire for additional "bureaucratic" complication and work in companies. But rather a demand for transparency and systematic treatment of climate risks and opportunities, first and foremost:

- adapting the company to current and future climate change; thereby protecting the company's financial capacity and potential (and thus the financial interests of stakeholders),

- mitigating climate change; global climate change has no limits and we all have a collective responsibility to constrain its impacts, to adapt our technologies and business models, and to find better economic solutions while preserving the quality of life and the viability of the economy.

Important points in the risk and opportunity assessment process:

Continuity of assessment of risks and opportunities; we need to understand that climate change brings constant change and risks for companies or their stakeholders. It is the responsibility of the board members to ensure that the company continuously updates its findings and coordinates activities. While some risks and opportunities can be identified through scientific references, for others we need to have a good understanding of our stakeholders and their business trends.

Methodology for assessing risks and opportunities; reliance can be based on standard methods of risk assessment, which need to be complemented by new knowledge on climate change, and the findings of climatologists need to be drawn upon. In the last few years, banks and insurance companies have also been incorporating climate risks into their models; it makes sense to work together on this. It is important for a company to develop several scenarios of the impact of climate change, it helps to have a "BAU" (business as usual) scenario among the scenarios, which can help a company to successfully determine the financial implications of the risks and to successfully argue for the necessary changes. Below are some sources of information that can be useful for businesses to inform themselves.

A deeper understanding of trends, developments, issues and needs of the company and environment; a broader understanding is needed to make informed assessments of which risks should not be underestimated in risk assessments. Board members must adequately inform the employees involved in the preparation of the risk and opportunity assessment of the strategic needs and orientations of the company.

Understanding the climate risks that affect the company directly and indirectly (through the supply chain and through user/customer behaviour); the company cannot assess the risks qualitatively with an internal team alone, but should invite its stakeholders into the dialogue, especially suppliers (suppliers' climate risks may be completely different, but they will affect the company directly), users/customers (climate risks may lead them to form new needs, habits), and experts.

Understanding the opportunities that may arise from climate change; in-depth knowledge of company trends and relevant stakeholders (as above for risks) can enable a company to react quickly and adapt successfully.

Knowledge acquisition & a broad, diversified team (with different expertise, experience and responsibilities); board members need to ensure that such knowledge and competences on climate change are disseminated to all levels of the company's organisation and operations. In the early stages of work in this area, it is useful to bring in the knowledge and experience of other companies and experts, but in the medium term the company must develop its own competences, methodologies and processes, which must be continuously updated.

Quantification of findings (financial assessment); in the initial process of identifying climate risks and opportunities, it will be difficult for the company to determine the potential financial burden, but it is important that the company develops methodologies for these calculations as soon as possible.

The assessment of risks and opportunities is unique to each company; while they may be tentatively determined by sector, location (geography), technology and other factors, a company will be most successful if it makes an assessment without excessive "copying" from others or from some generic documents.

As we learn the most from mistakes, here are some of the most common ones that can quickly result in companies being less "attractive" to business partners and/or in a poorer financial position:

- superficial approach to assessing risks and opportunities, not including different scenarios, overlooking important risks,

- concentration on short-term risks, neglect of medium- and long-term risks, which usually go beyond the methodologies used to set the company's financial projections (annual financial plans),

- negligence of transitional risks,

- professional team too narrow, non-involvement of the operational team,

- non-participation of financial experts,

- non-involvement of stakeholders, or disregard for their views,

- drawing conclusions about risks and opportunities based on qualitative descriptions (failure to take into account or quantify identified risks),

- failure to take account of findings in business decisions, strategies and investments, i.e. the assessment of risks and opportunities will not be reflected in the company's financial report.

Some facts about climate change:

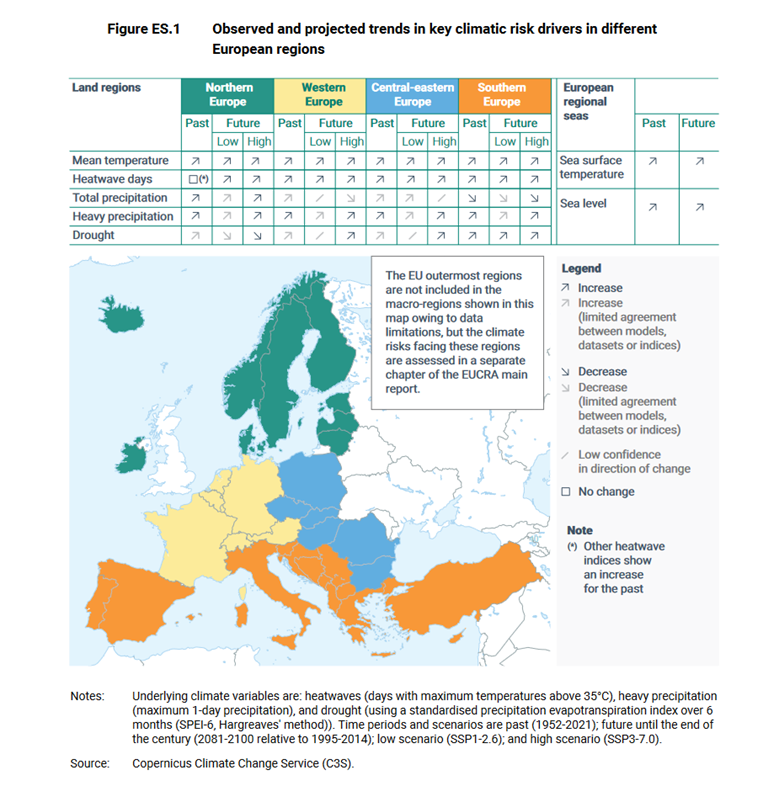

- Of all the world's regions, only Russia is warming faster than Europe.

- The frequency of damaging weather events has increased by 5 times in Europe since 1992 (global increase 3.5 times).

- Extreme rainfall events are increasing in quantity and extent of damage, while southern Europe can expect significant declines in rainfall totals and more severe droughts.

- Climate change is a risk multiplier that can intensify existing risks and crises. Climate risks can spread from one system or region to another, including from other regions to Europe.

- Cascading climate risks are already leading to systemic challenges that affect entire societies, impacting the economic performance of countries, societies and individuals.

Resources with more information useful for assessing risks and opportunities for businesses:

- The first report on environmental risks by the European Environment Organisation (EEA), with a special chapter and specific data for our region and for different sectors: https://www.eea.europa.eu/publications/european-climate-risk-assessment, March 2024

- Flying Blind Report; third consecutive annual report on the absence of climate and transition risks in financial reporting; https://carbontracker.org/reports/flying-blind-in-a-holding-pattern, February 2024

- WEF (World Economic Forum) Global Risk Report: https://www.weforum.org/publications/global-risks-report-2024, January 2024